Like many others, I was caught completely off-guard by the brutal 80%+ drawdown in AI coins last week. Since then, various theories have emerged to explain this collapse: the sheer number of tokens saturating the market, reducing attention spans, and the growing realization that many of these projects offered more hype than substance.

While these factors certainly played their part, I believe there's another crucial element driving not just shorter market cycles in the AI sector, but across all of crypto and, eventually, every speculative market. Rather ironically, this factor is AI itself.

Let me explain.

Faster Experimentation

Let’s align on two fundamental points.

-

Crypto is, for the most part, a software-powered industry. A blockchain depends on software modules called “clients” that run on computers across the world. Smart contracts and the front-end interfaces we use to interact with them are also nothing but code. Wallets, stablecoins, DeFi protocols, oracles, data tools, the TRUMP coin—it’s all code. (Notable exceptions are Bitcoin mining rigs and DePIN networks, but you get my point.)

-

Writing code is the single biggest task that AI has revolutionized so far. If you’ve ever coded with AI, you know this is true. Anthropic's recent analysisof user prompts confirms this empirically, while Cursor's meteoric rise to $100 million ARR—faster than any SaaS product in history—demonstrates it commercially.

Connect these dots and the implications become clear. If crypto is fundamentally code, and AI is becoming exponentially better at coding, then the entire development cycle accelerates dramatically. Consider:

-

New DeFi protocols that once required years of testing and development now launch within months

-

When projects like AI16Z create a new open-source AI agent framework meta, competitors emerge in weeks rather than months

-

Tools like@sentient_market, which I hacked together in a week, would’ve taken far longer. In fact, I probably wouldn’t have even built it had AI not been around.

-

No-code tools like v0, Replit, and crypto-native @devfunpumpare making it possible for even non-coders to test ideas rapidly

With faster software, the lifecycle of trends—from emergence to peak, including all the variations, copycats, and experiments along the way—has compressed significantly.

Faster Evaluation

What happens after a trend peaks? Market participants finally shake off their euphoric haze and start asking the hard questions. Is there genuine utility here? What actual problem does this solve? How is the ninth agent launchpad any different from the first eight? Where's the revenue model? Who's really behind this project?

This whole “due diligence” process isn’t easy. It requires genuine effort—reading documentation, testing products (if they exist), examining code, and most importantly, thinking critically. You might discover uncomfortable truths: the product lacks real utility, solves no meaningful problems, generates zero revenue, and comes from a team with questionable expertise in their supposed field.

Even when these realities stare you in the face, psychological barriers like bagholder bias and loss aversion often prevent you from accepting them and selling your shitcoins and vaporware.

But AI is changing this dynamic too. With tools like ChatGPT and Claude becoming ubiquitous, we all carry an infinitely patient, robotically objective analyst in our pockets—one that excels at logic, mathematics and code evaluation. Instead of parsing documentation and code ourselves, we can leverage these increasingly powerful assistants to help us evaluate projects systematically.

Moreover, the acceleration in software development has led to faster creation of evaluation tools. We're seeing early examples in agents like @soleng_agent and @AntiRugAgent, which automate basic sanity checks. Many "DeFAI tools" now include features for token evaluation. As computer and browser automation improves, we'll soon have AI testing entire product flows autonomously.

Perhaps most importantly, LLMs lack the emotional baggage and cognitive biases that plague human decision-making. They won't sugarcoat their analysis of that ninth copycat launchpad project just because you're holding its token. Their recommendations won't be clouded by your entry price or current losses. They simply provide objective analysis based on available data.

AI makes the sobering return to reality faster.

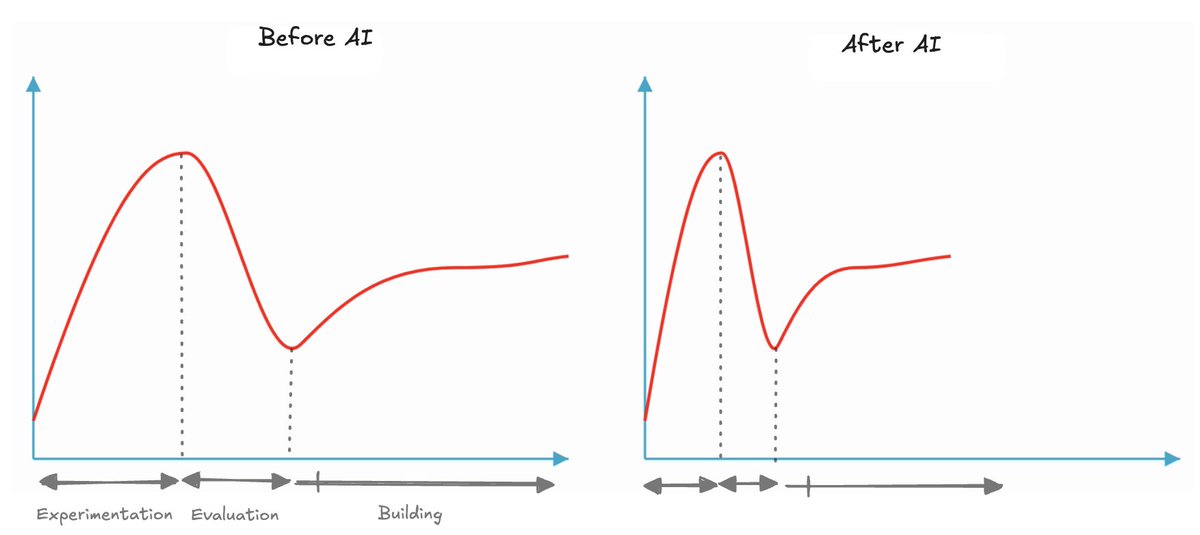

The Hype Cycle

Another lens to understand this thesis is Gartner hype cycle. You know what the cycle is so I won’t spend time explaining it. But take a moment to imagine what AI does to the typical trajectory.

Faster experimentation accelerates our journey to the Peak of Inflated Expectations. Similarly, faster evaluation speeds up our descent into the Trough of Disillusionment. Consequently, we arrive more quickly at the actual grind—the meaningful work of building products that solve real problems.

Implications

What does this mean for the market and cycles going forward?

First, AI is effectively making markets more efficient. Efficiency is nothing but valuing businesses for what they’re truly worth as quickly as possible. If the businesses get built faster and evaluated faster, then the market also gets efficient faster.

Second, with AI's capabilities growing exponentially and showing no signs of slowing, each subsequent hype cycle will likely be shorter than the last. As a market participant, this means you need to move swiftly—or risk becoming exit liquidity for others wielding AI tools (or perhaps even AI agents themselves).

For builders, the message is clear: rapid experimentation and ruthless discarding of failed ideas is crucial. Focus on building genuine solutions that the market needs, achieve product-market fit, and scale from there.

Where this trend leads to is, frankly, quite scary to think about. For now, I’ll leave you with some @nikitabier wisdom.